- Preface

- 1. Produce a Budget

- 2. Save and Invest Wisely

- 3.Manage Debt Effectively

- 4. Plan for Retirement

- 5. Insurance and threat operation

- 6. Enhance fiscal knowledge

- 7. Seek Professional Advice

- 8. Track and Examiner Charges

- 9. Minimize life Affectation

- 10. Automate Savings and Payments

- 11. Review and Optimize Financial Services

- 12. Cultivate an Emergency Fund

- 13. Practice aware Spending

- 14. Maximize Tax Efficiency

- 15. Regularly Review and Acclimate

Preface

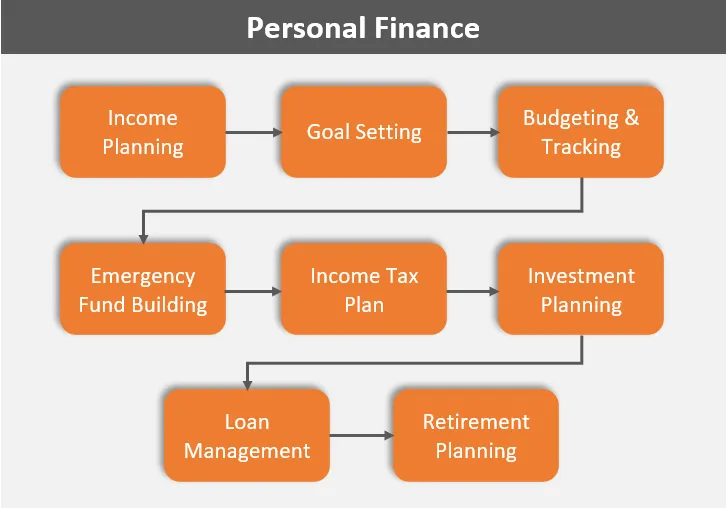

Personal Finance:- Managing particular finances is an essential skill that can empower individuals to achieve fiscal stability, meet their pretensions, and produce a secure future. still, navigating the complex world of particular finance can be inviting for numerous. This composition serves as a comprehensive companion, furnishing practical advice and strategies to help you take control of your finances and make a solid foundation for long-term fiscal well-being.

1. Produce a Budget

The first step towards achieving fiscal stability is to produce a budget. Assess your income, charges, and savings pretensions. classify your charges, secerning between essential and optional spending. Allocate finances for savings, exigency finances, debt repayment, and investments. Regularly review and acclimate your budget as demanded to ensure it aligns with your fiscal pretensions.

2. Save and Invest Wisely

Saving plutocrats is pivotal for unborn fiscal security. Begin by erecting an exigency fund to cover unanticipated charges. Aim for three to six months’ worth of living charges. Once you have an exigency fund, concentrate on long-term savings and investments. Explore colorful investment options, similar to stocks, bonds, collective finances, and real estate. Consider diversifying your investments to minimize threats and maximize returns. Start investing beforehand to take advantage of compounding growth.

3.Manage Debt Effectively

Debt can be a significant handicap to fiscal freedom. Prioritize paying out high-interest debts, similar to credit card debt, as snappily as possible. Consider strategies like the snowball or avalanche system to attack multiple debts. Avoid taking on gratuitous debt and use credit cards responsibly. Maintain a good credit score by making timely payments and keeping credit application low.

4. Plan for Retirement

Planning for withdrawal is pivotal, anyhow of your age. Start beforehand and take advantage of withdrawal accounts like 401( k) s or Individual Retirement Accounts( IRAs) to profit from duty advantages and employer-matching contributions. However, explore options like Simplified Hand Pension( SEP) or Solo 401( k) plans, If tone- employed. Contribute regularly and increase your benefactions whenever possible to secure a comfortable withdrawal.

5. Insurance and threat operation

guarding yourself and your loved ones from unanticipated events is vital. estimate your insurance needs, including health, life, disability, and property insurance. Compare programs, content, and decorations to find stylish options for your circumstances. Readdress your insurance content periodically to ensure it aligns with your changing requirements.

6. Enhance fiscal knowledge

Continuously educate yourself about particular finance to make informed opinions. Read books, attend shops, and follow estimable fiscal websites to stay streamlined on fiscal trends, strategies, and stylish practices. Learn about investment vehicles, duty planning, and plutocrat operation ways. The more you understand particular finance, the better equipped you will be to make sound fiscal opinions.

7. Seek Professional Advice

Consider consulting with a Pukka fiscal diary( CFP) or a fiscal counsel to help you develop a comprehensive fiscal plan acclimatized to your pretensions and threat forbearance. They can give substantiated guidance, review your investments, and help you make informed opinions grounded on your unique circumstances.

8. Track and Examiner Charges

Maintaining a record of your charges is pivotal to understanding your spending patterns and identifying areas where you can cut back. use particular finance apps or spreadsheets to track your charges regularly. dissect your spending habits and identify areas where you can make adaptations to align with your fiscal pretensions.

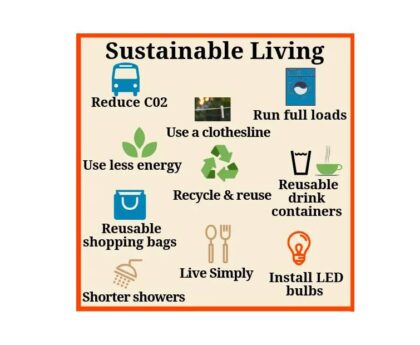

9. Minimize life Affectation

As your income increases, it’s tempting to indulge in a more lavish life. still, be aware of life affectation, where your charges rise proportionately with your income. Rather, concentrate on saving and investing a significant portion of your increased earnings to accelerate your fiscal growth.

10. Automate Savings and Payments

Take advantage of technology by automating your savings and bill payments. Set up automatic transfers from your checking account to your savings or investment accounts. This ensures that a portion of your income is saved without counting solely on your discipline. also, automate bill payments to avoid late freights and maintain a good credit history.

11. Review and Optimize Financial Services

Regularly review your banking services, credit cards, and other financial accounts to ensure you are getting the most stylish possible deals. Compare freights, interest rates, prices, and benefits offered by different fiscal institutions. Consider switching to accounts or credit cards with lower freights and advanced prices to optimize your fiscal deals.

12. Cultivate an Emergency Fund

An exigency fund provides a financial safety net during unanticipated situations similar to job loss or medical extremities. Strive to make an exigency fund that can cover at least six months’ worth of living charges. Keep the finances fluently accessible in a separate savings regard or a plutocrat request fund.

13. Practice aware Spending

Before making a purchase, ask yourself if it aligns with your precedences and long-term pretensions. Avoid impulse buying and give yourself time to estimate the necessity and value of the purchase. Consider espousing the 24-hour rule, where you stay for 24 hours before making a significant purchase. This helps help impulsive spending and promotes aware fiscal opinions.

14. Maximize Tax Efficiency

Understand the duty laws and explore strategies to optimize your duty situation. Take advantage of duty deductions, credits, and duty-advantaged accounts, similar to Health Savings Accounts( HSAs) and Flexible Spending Accounts( FSAs). Consider consulting with a duty professional to ensure you are maximizing your duty benefits while staying biddable with the law.

15. Regularly Review and Acclimate

fiscal planning is an ongoing process that requires periodic evaluation and adaptation. Review your fiscal pretensions, investments, and progress regularly. Assess any changes in your particular or fiscal circumstances that may bear adaptations to your fiscal plan. Staying visionary and adaptable will help you stay on track toward your pretensions.